Power of the Retail Investor

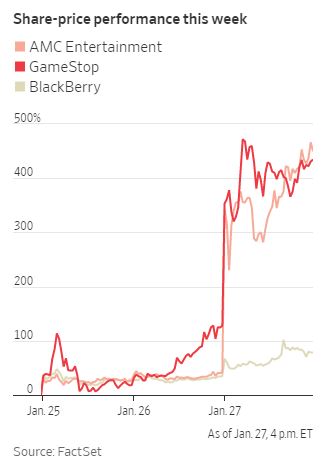

In recent weeks, and more notably recent days, shares of GameStop [GME] and AMC Entertainment Holdings [AMC] have been gobbled up hordes of retail investors. So much so that prices have gone up 320%, and 161% just since Monday, respectively. In “GameStop Mania Reveals Power Shift on Wall Street—and the Pros Are Reeling”, a recent article published in the Wall Street Journal, journalists Gunjan Banerji, Juliet Chung, and Caitlin McCabe explain how this has been happening and the culprit behind these mammoth price movements.

What started as a general conversation about the potential value of GameStop on popular platforms like Reddit, Facebook, Twitter and Discord has turned into an all-out war “between professionals losing billions and the individual investors jeering at them on social media.” So much so that regulators within the SEC are beginning to look into the potential of market manipulation.