Bitcoin: Blockchain, Mining, Energy

It’s no secret that Bitcoin and cryptocurrencies, in general, have gained significant popularity and notoriety over the last 12 months. Most notably because the return has been an astronomical 430% over the time period, but also due to companies such as Tesla, MicroStrategy, and Square investing a collective $3.9 billion earlier this year. For anyone invested in Bitcoin or following the asset, this last year has not been without its ups and downs.

What is Bitcoin?

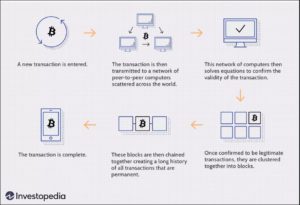

Bitcoin is a decentralized digital currency. All transactions made with bitcoin are noted on a public ledger and verified by a network of computers. Many people and companies are working to verify transactions instead of just one entity, making it decentralized. The public ledger of bitcoin transactions is stored in the blockchain.